Mar 12, 2024

Life Hacks

Struggling with Overspending?

Is overspending your problem?

The good news is you’re not alone! A majority of us tend to overspend in one area of life or another. I have even more good news for you! You can change it.

The road from impulse spender to wealthy and disciplined is not a 5 minute stroll in the park, but even small changes can lead to a much less stressful, resentful and fulfilled life.

There are some popular reasons for why you’re overspending. We usually use shopping to tackle negative emotions and give our mood a temporary boost. Obviously it's not working, that’s why you find yourself doing it again a moment later. I do the same with cookies or chocolate. If it was a permanent solution I probably wouldn’t have eaten chocolate cake today!

Overspending often comes from emotional triggers like stress, boredom or our low self-esteem. The buying impulse can be controlled, but it’s great to understand where you are now and what is pushing you towards overspending and then start using tools (like our app obviously) to start the work and make progress.

Another key reason why you might be overspending is social pressure and social comparison. You might feel compelled to buy in order to fit in or to stand out. So you might want to be in line with your neighbors or friends, or maybe you need to feel special and fulfill that need through excessive purchases.

Likewise tons of people find themselves buying products and services based on smart advertising. Marketing tactics have become so smart, we often don’t even realize we have been talked into something, which is not even in line with our wants and desires, not to mention our values.

Low financial literacy is the last popular reason for overspending on my list. In many families money is a taboo subject. When it surfaces, it’s often so emotionally loaded it’s like a volcano eruption. No wonder so many people stray from finding out the ins and outs of what their adult life’s welfare will be all about. The inherited emotional baggage tends to get stuffed as a scarecrow in a forgotten area of your memory.

You’re on the right track 👀

On the positive note, people who have a higher level of financial awareness, knowledge and ideally have been exposed to various personal finance principles and use them are much less likely to overspend and take on excessive and expensive debt.

And so just by learning about overspending you’re already on track to reducing it. Gaining financial literacy seems to be more and more important with every coming year as the world grows and gets more complex. Yet it’s way simpler than you think. It’s just veiled in these elaborate terms. Most people in finance themselves don’t use anything more than elementary grade math, so don’t feel discouraged.

Remedies

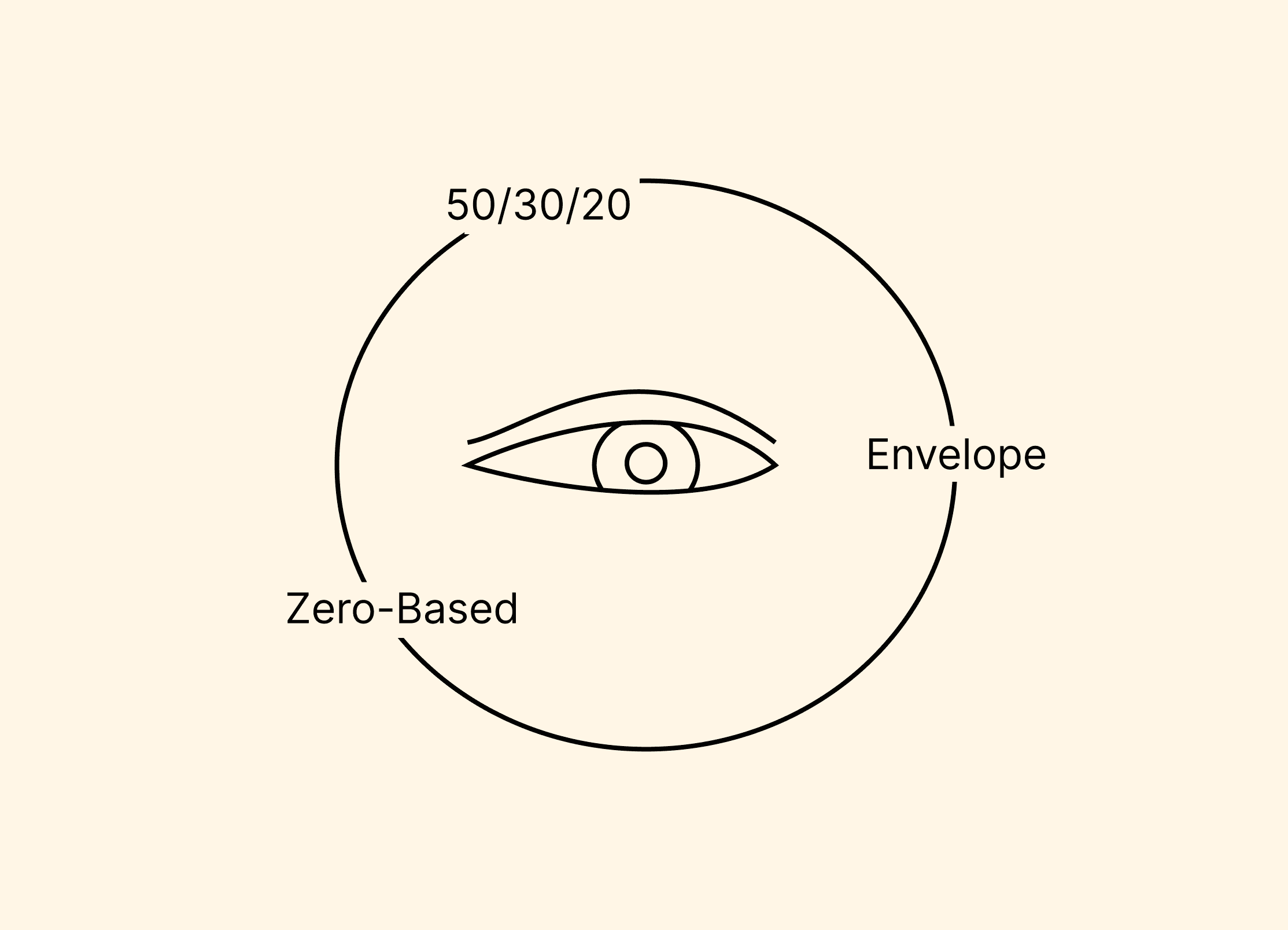

Budgeting and Tracking - Simple budgeting is dead simple. Sum up all your monthly bills. What’s left is the money you will pour into the budgets you establish. We like to keep it simple: savings, backup budget, maybe small investing fund, dailies budget. You divide your dailies budget by the number of days and know what’s the max you can spend each day (Our app does that for you, so it’s even easier).

Each day just keep track of your spending. I like to do it in the evening, or you can add as you go. Just keep in mind the total you shouldn’t go over each day.

Cash Envelope System - SImilar to the above system except you put the money from each budget as cash into envelopes. This does have its advantages, as a physical representation of money is tangible and for many easier to judge by. As cash flies out of the envelope you can really see when you’re running out of resources.

Delayed Gratification - I’d say this one is quite tricky for many as during your impulse, when you feel the urge to spend your hard earned cash you’re supposed to stop and think. Yep, think. It’s in fact amazing as in that very moment you’re transferring the power back to your logical you and you ask yourself:

“Does this purchase align with my long term financial goals?” If the answer you get is negative you don’t buy, you tell yourself “I decide to use this money to save and achieve my goals, because I’m awesome!”. This way you’re delaying gratification and winning in the long game.

Seek Support - In general people are good and helpful. What’s more, if they’re good at something they often like to tutor others on the subject. Lots of people run workshops, support groups, but what’s even more relevant, you surely know a person who’s great at controlling their finances.

Most probably they’re exactly the person you would not want to ask for advice for that very reason. They are different from you. That’s what we want! I’m not saying go and blindly follow their advice, yet if they’re great at finances, then obviously they must be doing something right. Listen to what they say and try to find the lessons, which align with you.

Reduce the Environmental Triggers - Have you ever been in a place, where you literally can’t buy anything? Sometimes I find myself far away from the city in the mountains. There’s some food in the cabin, the store is quite a distance away and up to recently there was no internet and no, I’m not telling you to move out to a cabin in Antarctica.

What I’m saying is that if you go for lunch break into a shopping mall your environment will be packed with triggers begging you to spend money. If you’re trying to reduce spending, that's the worst thing you can do to yourself! How about a take-out meal in the park with a colleague you can chat with?

Have Fun! - stopping overspending doesn't have to be painful and in fact you should have fun while doing it. If you’ll feel this is painful you’ll need some really powerful motivation to keep it up. Instead you can treat it as a game. Tick off each day when you don’t overspend and congratulate yourself. If you’re on a winning streak keep on rewarding yourself! Your mind will learn that saving is fun and thanks to the money you are now starting to accumulate you can get even more pleasure later. Yupee! 🤩

Don’t beat yourself up - if you’ve been overspending your whole life and it runs in your family acknowledge, that you’re up to a monumental task of change, which will probably affect not only you but also your whole family. Even if it’s not going great in the beginning, don't give up! It’s not the single day which will make a difference, it’s in the weeks and months ahead where your bright financial future is patiently waiting for you, so keep on working on it. It’s worth it. ✋

It’s Complex

Summing it up addressing overspending is not a one size fits all kind of a problem. We’re human, different and complicated. We have our history and dreams and so it’s good to look through the solutions and find the ones which resonate with you.

Thanks for reading! If you haven’t yet, give apqa a try!

Tomasz