Apr 4, 2024

Insights

A Budgeting Cinematic Journey

Imagine you’re about to embark on an epic journey through the world of cinema, but instead of action heroes and romantic plots, you’ll be meeting….. a cast of budgeting gurus. Yes, budgeting! It might not have car chases or love triangles, but it’s filled with its own variety of fascinating characters, each with unique traits and storylines. From the meticulous Zebb (Zero-Based Budgeting) to the tangible Esys (Envelope System), the budgeting world is as diverse as a blockbuster movie lineup.

Remember that every character has its role in the plot. Some might be more suited to your lifestyle than others, and that’s okay. The key is to understand each individual, appreciate their unique strengths, and find the one that’s the perfect co-star for your financial journey. So grab your popcorn, settle into your seat, and let’s dive into the exciting world of budgeting! 🎬

Zebb: Zero-Based Budgeting

Meet Zebb, the meticulous detective of our movie. Just like a detective leaves no stone unturned, Zero-Based Budgeting involves accounting for every dollar you earn. It’s about giving every dollar a job, whether it’s for bills, savings, or fun money. But remember, just like detective work, it requires discipline and attention to detail.

Key Scenes:

What is zero-based budgeting and how it works

Zero-based budgeting is a method where your income minus your expenses equals zero. In other words, every dollar you earn has a specific purpose - be it for bills, savings, or discretionary spending. It involves making a detailed list of all income and expenses each month, and ensuring that the total expenses do not exceed the total income.The benefits and challenges of Zebb

The benefits of zero-based budgeting include a high level of control over your money, the ability to quickly identify and cut unnecessary expenses, and a clear picture of where your money is going. However, it can be time-consuming to plan and track every dollar, and it may be too rigid for those who prefer a more flexible approach to budgeting.Who should consider using Zebb

Zero-based budgeting is ideal for individuals who like to have a detailed plan for their money and don’t mind spending time on budgeting. It’s also great for those who are trying to aggressively pay off debt or save for a specific goal, as it can help identify areas for cost-cutting.How to create a zero-based budget

To create a zero-based budget, start by listing all your sources of income for the month. Next, list all your expenses, starting with necessities like rent and groceries, then debts, and finally discretionary spending. The goal is to ensure that your income minus your expenses equals zero. If it doesn’t, adjust your expenses until it does. Remember to review and adjust your budget each month as needed.For starters

You can also begin by just tracking all the money that’s coming in and going out using the apqa app. This way after a month you’ll have a detailed list of your income and expenses. What’s more it will be based on your real life expenses, which is always more valuable.

Esys: Envelope System

Introducing the Esys, the old-school cowboy legend of our budgeting movie. Just like a cowboy relies on tangible tools, the Envelope System involves allocating specific amounts of cash to different spending categories, each represented by an envelope. It’s a simple, tactile way to manage your money. But remember, just like a cowboy’s life, it requires discipline and can be a bit rigid.

Key Scenes:

An Overview of the Envelope System

The Envelope System is a budgeting method that involves dividing your income into different categories of expenses, each represented by an actual or virtual envelope. Each envelope is filled with the cash allocated for that category for a certain period (usually a month), and you only spend from the designated envelope for each type of expense.The Advantages and Disadvantages of Esys

The Envelope System has several advantages. It provides a clear visual representation of your spending, helps curb overspending, and encourages mindful spending. However, it also has some disadvantages. It can be inconvenient to use physical cash in a digital age, it may not be suitable for complex financial situations, and it requires discipline to only spend the allocated amount.Who Might Find Esys Useful

The Envelope System can be particularly useful if you struggle with overspending or sticking to a budget. It’s also great for people who prefer a tangible, visual method of budgeting. If you’re new to budgeting, starring with Esys can be a great way to get started.Steps to Implement the Envelope System

Start by determining your income and the budget categories that apply to you (like groceries, rent, entertainment, etc.). Then, allocate a specific amount of money to each category based on your income and financial goals. Fill each envelope (physical or digital) with the allocated money. Spend only from the appropriate envelope for each expense, and once an envelope is empty, no more spending is allowed in that category until it’s time to refill the envelopes.

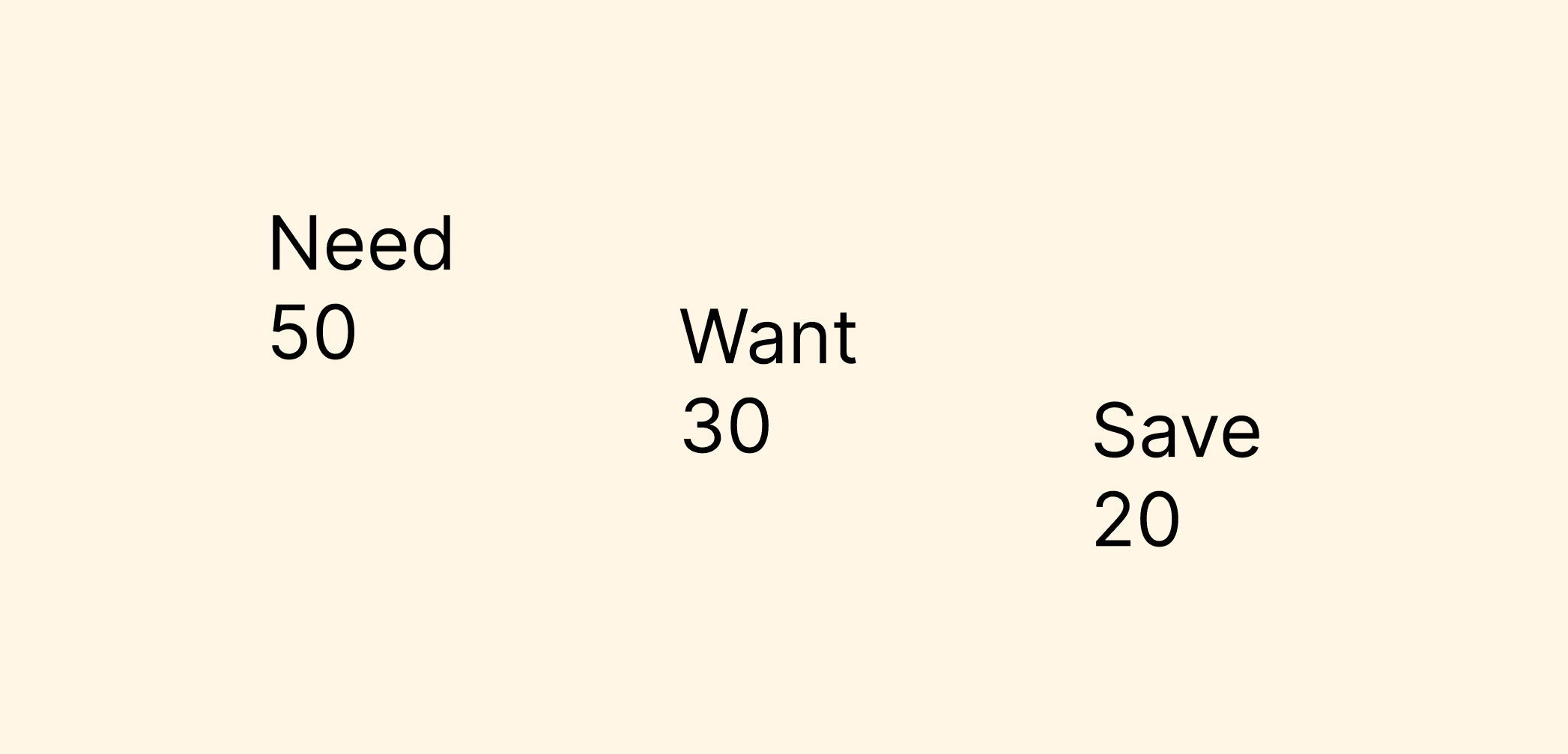

Triad: 50/30/20 Budget

Next up, meet the Triad, the balanced yogi of our budgeting movie. Just like a yogi seeks balance in all things, the 50/30/20 Budget is all about balance. It involves allocating 50% of your income to needs, 30% to wants, and 20% to savings. It’s a flexible, balanced approach to budgeting. But remember, just like maintaining a yoga pose, it requires practice and adjustment.

Key Scenes:

Understanding the 50/30/20 budget and its principles

Triad’s budget is a very simple way for managing your money. It’s like the leading actor in our movie who sticks to a script, but still delivers a stellar performance. The script, in this case, is a rule that divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings, investments and debt repayment. It’s a balanced approach, that ensures you cover your essential expenses, enjoy your present life, and secure your financial future.The pros and cons of the Triad approach

Like any leading actor, the 50/30/20 budget has its strengths and weaknesses. Its strengths lie in its simplicity and balance. It’s easy to understand and implement, and it ensures that all aspects of your financial life are addressed. However, it may not be flexible enough for those with irregular income or high necessary expenses. It’s also based on after-tax income, which might be difficult to calculate for some people.Who the 50/30/20 budget is best suited for?

It’s suitable for anyone looking for a simple and balanced budgeting method. Whether you’re a budgeting newbie or a seasoned pro, the 50/30/20 can be a good fit. It’s especially useful for someone with a steady income who wants to ensure they’re saving enough, spending wisely, and not overdoing it on unnecessary expenses.How to set up a 50/30/20 budget

Setting up a 50/30/20 budget is like preparing for a movie role. First, calculate your after-tax income. This is your total income minus taxes. Next, divide this income into three categories: needs, wants, and savings. Allocate 50% of your income to needs (like rent and groceries), 30% to wants (like dining out and hobbies), and 20% to savings and debt repayment. Track your spending to ensure you’re sticking to these allocations, and adjust as needed.

Libu: Line-Item Budgeting

Say hello to Libu, the meticulous architect of our movie. Line-Item Budgeting involves making a detailed list of every single income and expense item. It’s a thorough and precise way to manage your money. But remember, just like architectural planning, it can be time-consuming and requires regular updating.

Key Scenes:

What does working with Libu involve

Line-Item Budgeting is like the meticulous scriptwriter of our budgeting movie. Just like a scriptwriter details every scene, line-item budgeting involves listing every single income and expense item. It’s about having a detailed script for your money, where each line item represents a different category of your budget.The benefits and drawbacks of Libu

The benefits of line-item budgeting are its precision and control. It gives you a clear picture of where every dollar is going, which can help you identify areas for cost-cutting or increased investment. However, it can be time-consuming to create and maintain, and it may not offer as much flexibility as other budgeting methods.Who should consider using Libu

Line-item budgeting is ideal for those of you who prefer a detailed and organized approach to their finances. It’s particularly useful for those with multiple income sources or complex financial situations, as it allows you to see exactly where your money is coming from and where it’s going.How to create a line-item budget

Creating a line-item budget is like writing a script for a movie. Start by listing all your sources of income and expenses. Then, allocate a specific amount to each line item based on your income and financial goals. As you spend and earn money, track it against the corresponding line item in your budget. Review and adjust your budget regularly to ensure it stays accurate and relevant.

Val B: Value-Based Budgeting

Finally, meet Value-Based Budgeting, the wise philosopher of our budgeting movie. Just like a philosopher seeks to live in accordance with their values, Value-Based Budgeting involves allocating money in a way that reflects your personal values. It’s a personalized, flexible approach to budgeting that can bring great satisfaction. But remember, just like philosophical thinking, it requires introspection and honesty with oneself.

Key Scenes:

The concept of value-based budgeting

Val B is like the wise sage of our budgeting movie. Just like a sage seeks to live in harmony with their values, Value-Based Budgeting involves allocating money in a way that aligns with your personal values. It’s about spending money on things that truly matter to you and cutting back on things that don’t.The advantages and challenges of starring alongside Val B

The advantages of Value-Based Budgeting are its flexibility and personalization. It allows you to create a budget that truly reflects your lifestyle and priorities, which can lead to greater satisfaction and less financial stress. However, it requires self-reflection to identify what you really value most and discipline to stick to your budget and cut back on those unimportant things.Who might find value-based budgeting beneficial

It’s ideal if you want a personalized and flexible approach to managing your finances. Particularly if you feel restricted by traditional budgeting methods, as it allows for more freedom, but focuses more on aligning your spending with your wants.Steps to implement value-based budgeting

To implement Value-Based Budgeting, start by identifying your values. What truly matters to you? Next, look at your spending. Does it reflect your values? If not, make adjustments to align your spending with your values. Remember to review and adjust your budget regularly to ensure it stays aligned with your values.

And that’s a wrap folks. Remember, the key to successful budgeting is to choose a method that aligns with your financial goals, lifestyle, and spending habits. Each budgeting method has its strengths and weaknesses, so it’s important to choose the one that works best for you and then stick with it.

Just like a movie, your budget needs time to unfold. It's important to give your chosen budgeting method a fair shot before deciding if it's right for you. This means sticking with it long enough to truly understand its dynamics - the plot twists, the climaxes, and the resolutions. Only then can you appreciate its strengths and acknowledge its weaknesses.

So, don't rush to change your budgeting method if it doesn't seem to work right away. Be patient, stay on course, and give it time to play out. You might be surprised at what you learn about your spending habits and how you can improve them.

Remember, budgeting is not a one-size-fits-all solution. It's a personal journey that's unique to each individual. So, find the budgeting method that works best for you, stick with it, and watch your financial story unfold.

Happy budgeting and enjoy the movie! 🎬