Apr 9, 2024

Insights

Retire Like a Pro

The Power of Early Savings & Investments

Retirement. It’s like those distant relatives who always promise to visit, but never seem to show up… until they do. Time has a funny way of speeding up as we age, doesn’t it? Well let me tell you, that process doesn’t stop! One day you’re in your prime, juggling work, family, and exciting social life, and the next, you’re wondering how those last 30 years sped by so fast.

But here’s the good news: with all those years comes a wealth of experience and knowledge. You’ve navigated the ups and downs of your life, and now you’re in a unique position, you can make all your hard earned knowledge and experience - wisdom - start working once again to your advantage. Ever thought about starting a side business? Or perhaps investing a portion of your income? It’s time to put your hard-earned money and know how to work for your future self.

Remember, what seems easy now might feel impossible when we’re older. So, don’t waste time. Start planning for retirement today. It’s easier than you think. And here’s a little secret: even if you put aside a small sum today, thanks to the magic of compound interest and investing, it could turn into a serious cash pile for your future self.

So, let’s dive in and explore how you can retire like a pro. And remember, time flies, but you’re the pilot. So, fasten your seatbelts and get ready for takeoff!

Why Starting a Retirement Stash Now is Key

Ever heard the saying, ‘Better safe than sorry’? It’s an oldie but a goodie, especially when it comes to retirement savings. Think of it this way: Be an optimist today, but prepare for tomorrow. If things go well, you’ll have extra funds handy, which you can use to help your friends, family, or even yourself. It’s like packing an umbrella for a longer trip - you might not need it, but it’s good to have just in case.

Small, strategic investments made throughout your lifetime can yield exponential rewards. It’s like planting a seed and watching it grow into a mighty tree. These golden opportunities don’t pop up every day, so playing the long game increases your chances of hitting a home run with one of your investments. Remember, Rome wasn’t built in a day, and neither is a robust retirement fund.

Learning to save and invest really is a journey. Each year, you grow not only financially but also personally. You evolve into a more informed saver and a savvy investor. I used to think investing wasn’t for me. Sure I made my share of mistakes when I started off, but it paid off. Nowadays there are tons of valuable content accessible for free and if you’re ready to go for it and spend $10, there’s a plethora of amazing books which will get you far on your journey.

There will be moments in your life, when you’ll have more spare cash. Take advantage of them as investing larger sums in those moments becomes less painful. Also making saving and investing a monthly habit is an amazing way to stay ahead. It’s like going to the gym - the first few days might be tough, but once you get into the rhythm, it becomes second nature.

Lastly, don’t forget to celebrate your wins along the way. Take profits when it makes sense to do so. This not only provides a sense of accomplishment, but also reinforces the habit of saving and investing. For example you can set a percentage, which you will annually take from the profits of your investment fund.

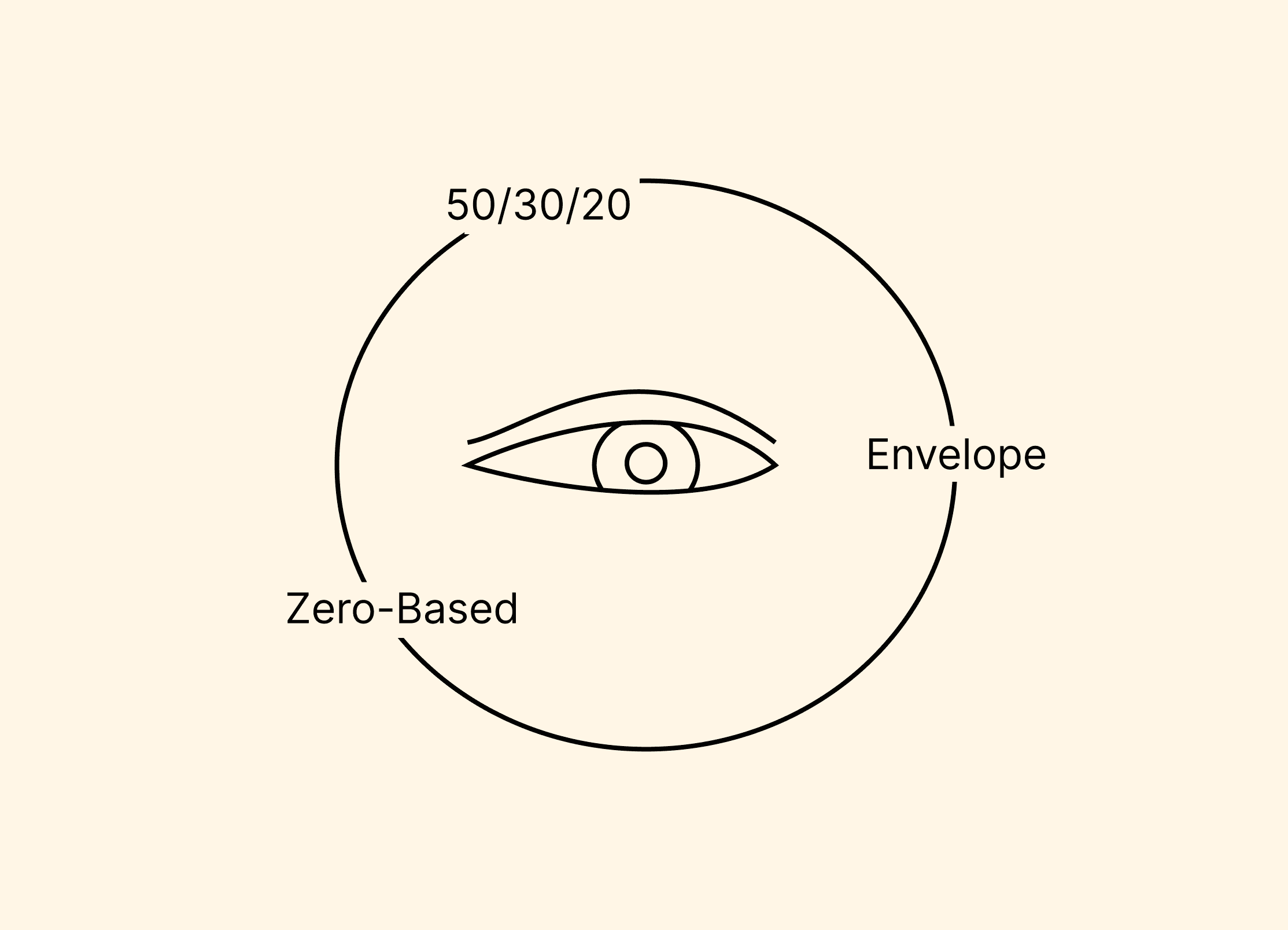

How Much Do You Really Need to Save for Retirement?

Saving 15% of your pre-tax salary for retirement is a good starting point, but it’s not a one-size-fits-all solution. It’s like trying to wear your high school jeans in your 40s - it might work for some, but…

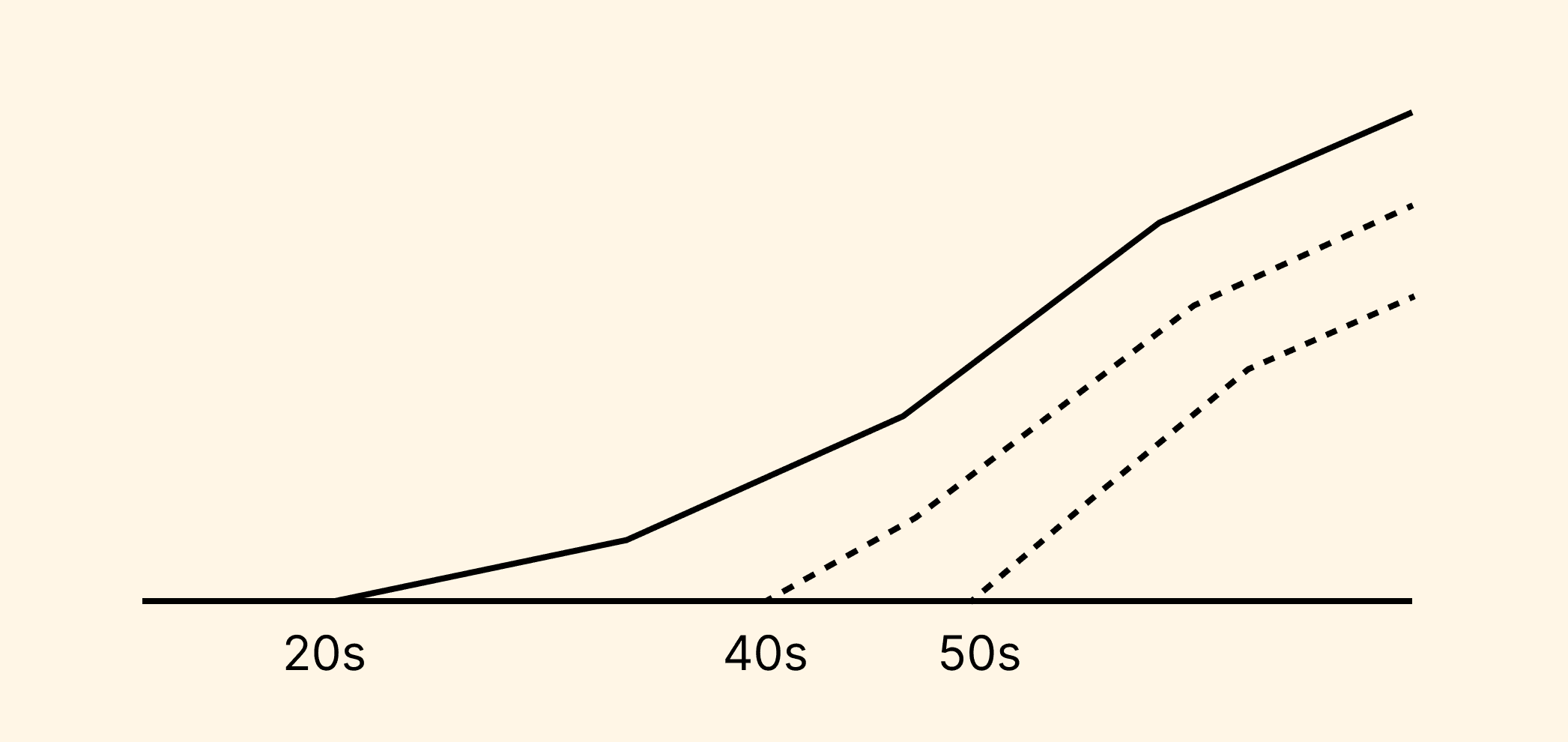

If you’re starting to save later in life, say in your 40s or 50s, you might need to pump up those savings beyond 15%. Why? Because compound interest, growth of your favorite ETF of group of stocks is a marathon, not a sprint. The earlier you start, the more time your money has to grow. If you’re late to the party, you’ll need to make up for lost time.

Thankfully, many retirement plans, like IRAs and 401(k)s, offer a lifeline in the form of catch-up contributions. If you’re over 50, you can contribute extra on top of the regular contribution limit.

Finally, you might need to adjust your investment strategy to a slightly higher risk tolerance. Since you have less time, you might need investments with the potential for higher growth. But remember, with great potential comes great risk. So, tread carefully.

Obviously how much you’ll need for retirement is a personal calculation, so is how much you should be stashing away. It depends on when you start, how much you earn, and what kind of lifestyle you want in retirement. So, start crunching those numbers today.

Retirement or Passion Project?

Most people follow a traditional work system: earn a salary, save, invest a bit, and retire. But what if you could retire early or not work at all?

There are two ways to approach this. The first involves doing something you love so much that retirement isn’t even on your radar. If the thought of not doing your passion makes you miserable, then retirement might not be for you. If you’re currently in a 9 to 5 job, could you consider a change? Often, we’re even better at our hobbies than our day jobs. Does that ring a bell? With a solid business plan, your hobby could potentially become a more lucrative endeavor.

However, turning a passion into a full-time job is often easier said than done. So, let’s explore other options. Consider starting small with a side project. Reach out to friends and family, ask for referrals, and see where it takes you. Now, think about your retirement calculation. If the additional income from your passion project went fully into your savings and investments, you might achieve financial freedom earlier. That’s real value, as time is priceless!

Next up is passive income. For instance, if you can save for down payments for real estate to rent out, growing a portfolio of rental properties can be an amazing path to financial freedom at any age. However, this isn’t for everyone, especially if you’re just starting out. The key here is to monitor your monthly cash flow closely and ensure your passive income stream grows steadily.

By investing more time in thinking about retirement, you might discover many new opportunities within your reach. Saving, investing, earning passive income, and pursuing side projects aligned with your passions are all vehicles that can radically change your life.

Financial Advisors

Choosing to hire a financial advisor is a serious decision. If you decide to go this route, make sure to hire a fiduciary. Unlike some advisors who are obliged to offer company-centric solutions, fiduciaries are ethically bound to act in your best interest. It’s like having a personal trainer who’s committed to your fitness goals, not their gym’s membership numbers.

Remember, trust is earned, not given - especially when it comes to your money. The internet is rife with tales of people losing their savings to ‘guaranteed’ investments. Even if your advisor is your highschool bestie, don’t take the risk, spread out your assets.

Also diversify your investments across a range of financial products and passive income streams. It’s like having a well-balanced diet - you need a mix of nutrients to stay healthy.

Remember, you’re the captain of your financial ship. You’re fully responsible for any profit or loss. Learning about finance might seem daunting, but it’s simpler than most advisors make it out to be. They often use complex terms to make you feel like you’re trying to decode the Da Vinci Code, but don’t be fooled.

Many people manage their own money with greater success than most financial advisors. It’s like cooking your own meal - it might not look like a five-star dish, but it often tastes better because you know exactly what went into it.

So, what’s the next step on your journey to financial freedom?

Start by taking stock of your current investments and savings. Add them up to get a clear picture of where you stand today.

Next, leverage one of the many free online calculators to gauge whether your current trajectory aligns with your desired lifestyle in retirement.

Take some time to revisit your current investments and income sources. Are they working hard enough for you?

Consider embarking on a side project that aligns with your passions. Dedicate a portion of this income to your future self. It’s like sending yourself a gift in the future!

And finally, never stop learning. In the long run, investing in yourself yields the highest return.

Remember, the journey to retirement is a marathon, not a sprint. Every step you take today brings you closer to your goal. Happy planning!